Fleet expenses are increasing at a rapid pace. While most attention is being paid to diesel prices, that’s not the only thing taking a bite out of profits. An article in Heavy Duty Trucking took a look at the factors driving these costs. Along with expensive fuel, fleets are dealing with increased equipment prices and a weakening freight market.

Currently, inflation is at 8% per year. Remove food and energy, which experience fluctuations due to factors outside of the rest of the economy, and inflation is still at 6%. This isn’t like spikes we’ve had in the past. Instead of having a disruption in one or two sectors, all industries are effective. Petroleum and food supplies are being disrupted by the Ukraine war, while manufacturing disruptions caused by the pandemic are making everything from raw materials to computer chips more expensive. The Federal Reserve is raising the federal funds rate to curtail inflation, but it’s not clear if this method will be as affected as it was in the past.

Aside from diesel prices, the biggest increases fleets have had to face is in the Producer Price Index (PPI) for trailers. The PPI estimates values for business to business sales. The largest one month gain in the category’s history came last October, with prices going up by 10.5%, followed by the third highest gain in January (5.5%) and the second highest in February (6.3%.) These price increases are driven by an increase in the price of aluminum, steel, lumber and other raw materials used to build trailers.

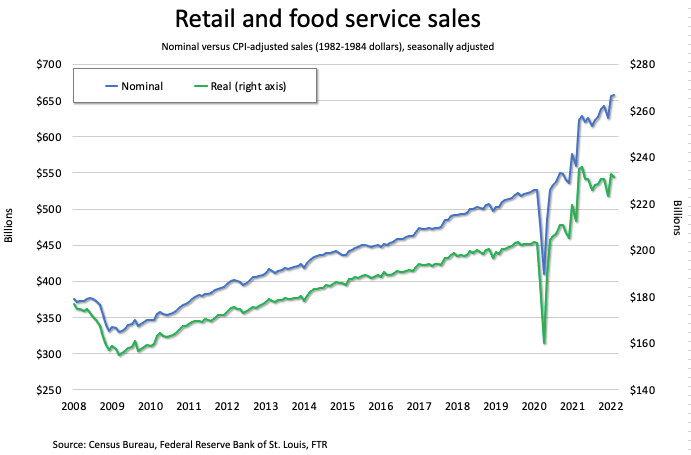

If goods cost more and people aren’t making enough to keep up with expenses, they buy less. In turn, that means there’s less demand for freight. Compared to February 2020, February 2022 sales were 25.2% higher. Adjust prices for inflation, those sales were 14.1% higher. However, sales volume decreased: people are cutting corners to compensate for increased spending elsewhere. It’s estimated that retail and food service sales fell by half a percent in February, and there are fears that we’ll see more losses, leading to a weak freight market over the coming months. However, not everything is doom and gloom. Microchip supplies are increasing, with a full recovery from chip shortages expected early next year. This should have a massive impact on the supply and prices of new trucks, while boosting freight as electronics and automotive companies meet pent-up demand for products.

Additional credit:

Trucking’s Inflation Worries Go Beyond Fuel – Fleet Management – Trucking Info